Maximizing Your Loaning Possible: Tips for Taking advantage of Funding Opportunities

The globe of car loans can be a complicated and in some cases daunting one, with different opportunities presenting themselves in different kinds. It all starts with a thoughtful evaluation of one's monetary standing and a proactive state of mind towards leveraging car loan opportunities.

Examining Your Financial Circumstance

Upon starting the journey to take full advantage of car loan chances, it is essential to start by thoroughly analyzing your present monetary circumstance. Understanding your financial standing is the foundation of making informed choices when it comes to obtaining cash. Beginning by assessing your earnings, costs, possessions, and responsibilities. Compute your debt-to-income proportion to see just how much of your income goes in the direction of paying off debts. This proportion is a necessary metric that loan providers think about when determining your qualification for a finance.

Looking Into Car Loan Options

To efficiently browse the landscape of finance opportunities, extensive research study into various funding options is essential for consumers seeking to make informed financial decisions. Carrying out extensive research includes discovering the terms provided by various loan providers, understanding the types of finances available, and comparing rates of interest to recognize one of the most beneficial alternatives. By delving right into the specifics of each lending product, borrowers can gain insights into settlement terms, fees, and potential charges, enabling them to select a car loan that lines up with their monetary objectives.

Additionally, seeking advice from with monetary advisors or lending officers can supply tailored guidance based on individual scenarios. Eventually, complete research study equips debtors to make well-informed decisions when choosing a financing that fits their demands and economic abilities.

Improving Your Credit History Rating

After completely investigating car loan choices to make informed monetary decisions, borrowers can now concentrate on boosting their credit rating to improve their overall loaning possibility. A higher credit history not just increases the possibility of financing authorization yet likewise permits borrowers to gain access to loans with better terms and reduced interest rates. To enhance your credit history, start by getting a duplicate of your credit scores record from significant credit history bureaus such as Equifax, Experian, and TransUnion. Testimonial the report for any type of errors or discrepancies that could be adversely affecting your score, and without delay basics resolve them by getting in touch with the credit rating bureaus to remedy the errors.

Understanding Lending Terms

Comprehending car loan terms is crucial for customers to make educated financial choices and find effectively manage their borrowing obligations. Funding terms include various facets such as interest rates, repayment timetables, charges, and fines. Rate of interest can substantially affect the total amount paid off over the finance term. Debtors should recognize whether the rates of interest is taken care of or variable, as this can influence their regular monthly payments and overall cost. In addition, understanding the payment routine is vital to ensure timely settlements and avoid default. Some car loans may have prepayment charges, which borrowers ought to consider if they plan to settle the financing early. Charges, such as origination costs or late payment costs, can likewise contribute to the expense of loaning. By extensively understanding these terms prior to concurring to a funding, customers can make sound monetary choices and stay clear of prospective mistakes. It is recommended for debtors to very carefully evaluate and compare loan deals to select the most desirable terms that straighten with their financial goals.

Creating a Settlement Plan

Having a clear understanding of finance terms is essential for debtors seeking to produce a well-structured repayment plan that lines up with their financial objectives and decreases potential threats. Once the car More Bonuses loan terms are comprehended, the following action is to establish a settlement method that fits the borrower's monetary capabilities. The initial consideration ought to be establishing a sensible timeline for repayment. This involves analyzing income sources, budgeting for routine repayments, and accounting for any type of direct modifications in financial conditions. In addition, focusing on high-interest lendings or those with rigid payment problems can help in reducing total financial debt problem with time.

If problems develop in conference payment commitments, informing the lender early on can open up chances for renegotiation or restructuring of the loan terms. Eventually, a well-thought-out repayment strategy is important for fulfilling finance commitments responsibly and preserving a healthy monetary profile.

Final Thought

Finally, making the most of borrowing possibility calls for an extensive assessment of economic status, study on car loan alternatives, renovation of credit report, understanding of car loan terms, and the creation of an organized payment plan (Online payday loans). By adhering to these steps, individuals can make the most of car loan possibilities and achieve their monetary goals efficiently

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Kelly Le Brock Then & Now!

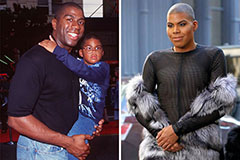

Kelly Le Brock Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!